For many people, the most valuable item in all of their possessions is a watch. This could be because it’s a family heirloom, or because it has deep sentimental value, or because the watch literally cost them tens of thousands of dollars. Whatever the reason, if that watch were to be stolen, lost, or broken, it would be devastating. For insurance purposes, people ask if watches are jewelry.

The short answer is yes, watches are considered jewelry, especially for insurance claims. Watch aficionados may refer to watches as an investment, fashion experts may call them accessories and smartwatches fall under the category of wearable electronics, but watches are often sold together with jewelry in retail settings.

Most people insure their valuables in case of something unthinkable. For valuables like rings and diamond earrings, jewelry insurance is recommended to ensure their full value is recognized. Wristwatches and other similar timepieces tend to be thought of as jewelry, yet it’s not always clear that a generic jewelry insurance policy covers watches.

Here’s what you need to know if you want to make sure your cherished watch collection is properly insured.

Table of Contents

Why Get Jewelry Insurance?

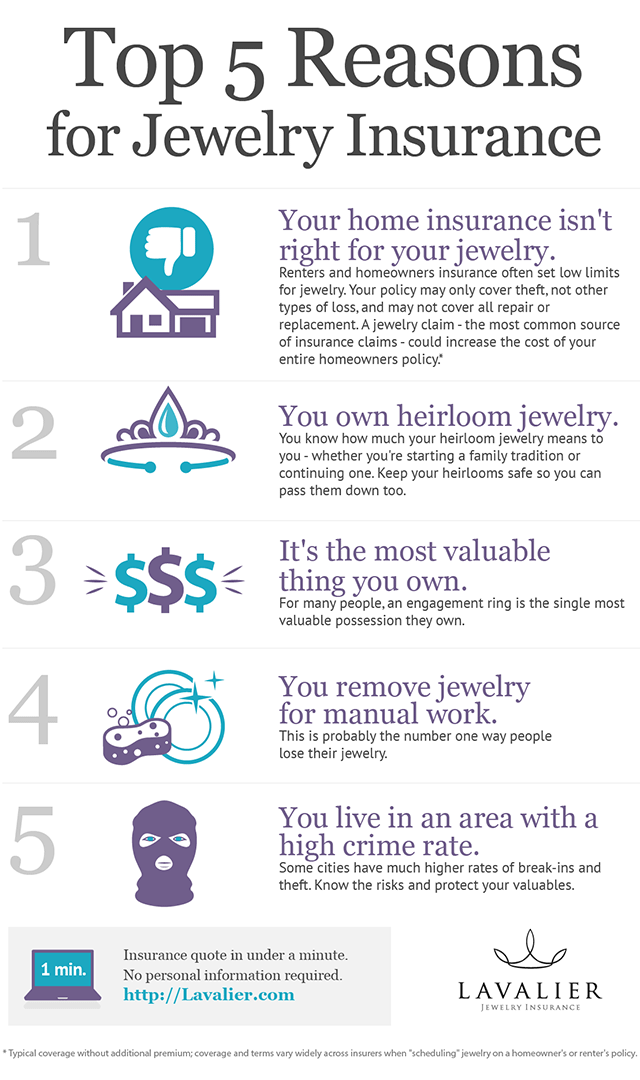

It might seem like an obvious question to answer, but in fact, it’s not always clear who should get a policy. Jewelry insurance is often recommended because home insurance policies can be spotty with their coverage of valuables (some explicitly don’t cover such items). If your homeowner’s policy or theft insurance covers jewelry, then alright, you’re probably set. But maybe not.

If the items in question are of a particularly high value (either monetarily or sentimentally), you should consider jewelry insurance.

Most jewelry insurance policies will generally cover a broad range of situations, including “damage, theft, accidental loss, and mysterious disappearance.”

This is necessary because many general home insurance policies won’t cover accidental loss, which means an engagement ring that slips off your finger and down a drain won’t be covered.

The same issues can be a concern for people with valuable watches or large watch collections. Unless you have made a point of searching for a homeowner’s policy that specifically covers your timepieces, you would be wise to invest in more specific insurance.

Jewelry Insurance vs Watch Insurance?

There is no blanket answer to whether or not watches are covered by jewelry insurance because there is no single type of jewelry insurance. Policies vary depending on what state you live in, or even city (not to mention country), and they vary from company to company. Most insurers offer different policies at different price points. If it’s a good policy, your watch will almost certainly be covered. If it’s a cheap policy, well, you get what you pay for.

If you don’t have a lot of jewelry and you’re only interested in insuring your watch collection, there are separate watch insurance policies. You can often get such policies through your regular insurance company or through the watch seller. These policies, like the general jewelry insurance policies, protect you against loss, theft, or damage.

There is another good reason to get specialty jewelry or watch insurance. Even if you have general coverage for your possessions, most broader insurance policies put a cap on how much they’ll pay for a particular item.

So, even if you can prove the Omega De Ville you had stolen from your bedroom was valued at $10,000, you may only get back $2,000

If you take out a policy specifically for your watch or watch collection, it will cover the total appraised value.

How Much is Watch Insurance?

Like all insurance policies, the price for watch insurance varies depending on the value of the watch (or watches) and what the policy offers.

At least one estimate puts the cost of insuring a $5,000 watch at between $50 and $100 a year, with that price doubling as the value doubles.

That can be a hefty price to pay, but it won’t seem like all that much if you lose or damage your beloved Rolex Datejust.

Will Watch Insurance Cover Smartwatches?

Smartwatches are becoming increasingly popular, and with that comes many new questions that we never had to consider before. Sure, a smartwatch is technically a watch (it’s right in the name), but for all intents and purposes, it’s more of an electronic device. Insurance policies for electronics tend to differ considerably from jewelry insurance.

If you get very technical, and the Canada-based National Bank Insurance did, smartwatches are wearable tech, and therefore not watches.

Just as you might insure your smartphone, if you buy an Apple Watch Series 7 you’d be better off just getting AppleCare+ as extra insurance.

On the other hand, if you invest in the limited edition Sunrise PINNACLE by Nico Gerard, then jewelry insurance might be in order.

This more than $100k 18 karat gold timepiece is a Swiss-made analog watch that includes an authentic Apple Watch in the band, opposite the main case.

It’s more of a collectible than a functional smartwatch, and for that reason, if you are one of the 88 people who own one, you should definitely invest in a high-end watch insurance policy.

Believe it or not, there are $100K+ smartwatches! See the most expensive smartwatches you can buy here.

Should I Get Watch Insurance?

The question of whether or not to buy special insurance for your watch relies on a number of factors. For most people, as long as you have home insurance and your watch is only a fashion watch or a cheap digital timepiece, watch insurance would be overkill. A company probably wouldn’t offer a separate policy if the watch wasn’t valued at at least $1,000.

Also, if the watch has considerable sentimental value but isn’t monetarily valuable, watch insurance isn’t going to do you much good. You can’t buy back a memory or a watch’s history. Of course, if the timepiece also happens to be valuable, then the personal connection may be lost, but you can still appreciate getting a hefty check in return. It might not replace the missing heirloom, but it will allow you to get something new.

Personally, I wouldn’t insure a watch that was less than $5,000, but of course, that’s just me. Everybody’s relationship to their watch collection is different, and there’s no way to quantify personal value. Fortunately, literal value is quite quantifiable, and if you lose, damage, or have your watch stolen, it’s nice to be able to get that back, at least.